I'm not sure I understand everything Jimbo says here, but it's definitely worth thinking about.

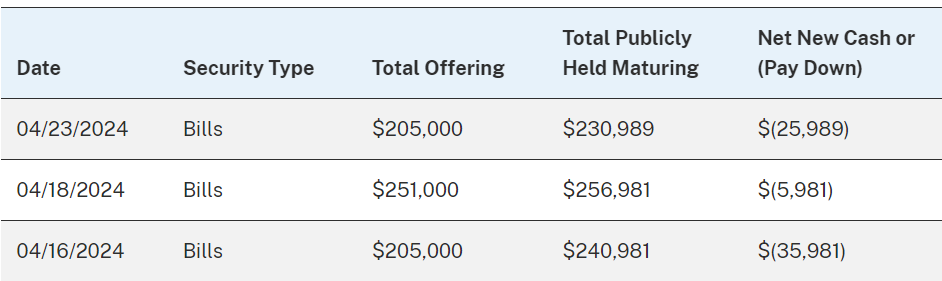

But it looks like it's time for a little rally in Treasuries as T-bill paydowns temporarily flood investor accounts with excess cash.

A couple weeks of dropping yields to come. Warning Signs Abound, But Ignore Them for Now

Does similar logic apply to stocks? One More Rally To Go

As for the intraday stuff, every time I spy a bottom on the ES 24 hour S&P futures, it turns out to be a mirage. I've been hallucinating. Now it looks as though the market has been in a 5 day cycle flat up phase since Monday evening.

If this is the up phase, I can't wait to see the down.

If they break 5005, the first step looks like 4975. To make that moot, they would need to clear 5045 on the upside.

Zooming out to 5 hour bars, you can see why I like 4975 as a target. But you can also see an impressive top pattern with a conventional measured move target of 4850. Since nobody believes this selloff, including me, ergo, nobody is short. And if nobody is short, then he won't be covering on the way down. Only nobody knows what nobody is thinking. So I'll let the screens do the picking and hope they keep on ticking. Swing Trade Screen Picks – List Shrinks With Good Profits

For moron the markets, see:

Warning Signs Abound, But Ignore Them for Now April 16, 2024

Swing Trade Screen Picks – List Shrinks With Good Profits April 15, 2024

No More Downside April 15, 2024

Back to the Gold Old Days 4/9/24 April 9, 2024

March Withholding Tax Collections Actually Stunk April 5, 2024

Banking Data Says This Is Last Hurrah for Stocks April 3, 2024

The End Is Not Nigh March 26, 2024

Markets Create Money, Money Talks, Markets Listen Etc. March 12, 2024

If you are a new visitor to the Stool, please register and join in! To post your observations and charts, and snide, but good-natured, comments, click here to register. Be sure to respond to the confirmation email which is sent instantly. If not in your inbox, check your spam folder.